LNG Bunkering Vessel for Polish market – a strategic need in the era of Net-Zero shipping and an opportunity for growth of Polish maritime companies

Polish LNG bunkering vessel concept – SE-618 Shallow Draught LNG BV/Feeder for long-range shipping witin the Baltic Sea

Climate changes and the resulting need for energy transition are now undeniable facts. In the light of GHG strategy for maritime transport adopted in 2023 (2023 IMO Strategy on Reduction of GHG Emissions from Ships), decarbonization targets have been adopted for the first time in the history of international maritime sector. The priority is to reduce greenhouse gas emissions by at least 20% by 2030, then by 70% till 2040, until net-zero is achieved around 20501.

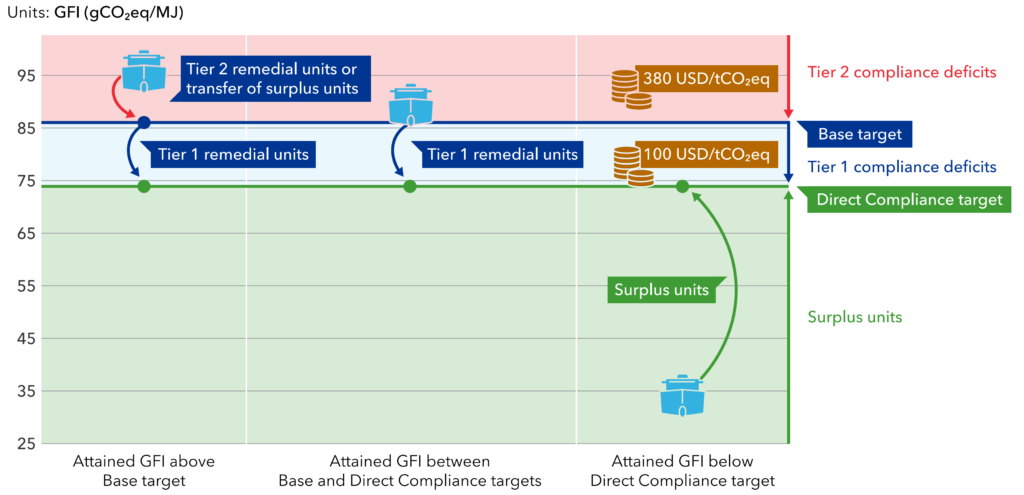

Under IMO Net-Zero Framework (NZF) proposal, shipowners will be required to gradually reduce their greenhouse gas (GHG) emissions intensity, taking into account their total emissions, including whole fuel production process known as “well-to-wake.” In addition, they will be covered by a global economic mechanism, including a tariff system with specific thresholds if GHG emissions intensity is too high, and a credit system for ships with lower emissions as a reward for using alternative fuels.

Illustration of compliance approaches in the NZF exemplified for the 2030 targets, raport DNV Maritime Forecast to 2050

In this context, Polish ports and the domestic bunkering sector face an urgent need to adapt to new reality. The growing demand for alternative fuels and the specific bunkering operations required show that investments in polish infrastructure and the need of bunkering vessels (BV) are not only a matter of competitiveness, but also a necessity resulting from the global regulatory order.

Current situation and market needs – Europe and Poland

Taking into account increasing regulatory pressure and growing availability and competitiveness of liquefied natural gas (LNG) fuel, maritime sector faces the need to adapt both its infrastructure and bunkering logistics solutions. According to DNV Maritime Forecast to 2050 report, investment in alternative fuels, including LNG, is reaching a new stage. From the European perspective, this is a response to the requirements of the EU Clean Power for Transport package (Directive 2014/94/EU), which requires TEN-T ports to be equipped with LNG bunkering facilities2.

On the European market, LNG bunkering infrastructure is developing dynamically. In 2020, there were already 59 ports with a total number of 71 LNG installations within EU3. Reports indicate significant growth in 2024-2025, with the number of ports with access to LNG bunkering estimated at around 198, with another 78 planned for upcoming years4.

The situation in Poland is also evolving. Existing and planned LNG installations, development of small-scale LNG, and first LNG bunkering operations in Polish ports, only from land so far, indicate that the domestic market is entering the implementation phase. For example, after its expansion, LNG terminal in Świnoujście has a processing capacity of 500 000 m³ of LNG, a nominal regasification capacity of up to 8,3 billion m³ per year, and an export pier dedicated for LNG. This represents significant potential for growth.

LNG demand versus resources

Although there is currently no detailed data available for Poland regarding LNG bunkering volumes, global forecasts indicate that demand for LNG will at least double by 20305.

In Polands’ case, considering the development of ports in Gdańsk, Gdynia, Szczecin and Świnoujście, as well as the requirements for alternative fuel infrastructure according to EU directives, we can assume that the demand for LNG bunkering will grow at a double-digit annual rate in the coming decade.

Although the domestic market is still developing, the prospects are significant and specific needs are emerging. The lack of a dedicated LNG bunkering unit in Poland indicates a gap, the elimination of which could contribute to increased bunkering efficiency, reduced logistics costs, and improved competitiveness of Polish ports. Ports will need dedicated units that will enable efficient, safe and competitive LNG supplies to their own ships and large vessels reaching Polish ports, which currently have to plan their routes based on available LNG supply options within other European harbours.

Why LNG ?

The aforementioned Maritime Forecast to 2050 report indicates that although LNG is not a zero-emission fuel, it is currently the most technologically and logistically mature transitional fuel for shipping, providing significant emission reductions compared to traditional ones. According to DNV analyses, the use of LNG reduces CO₂ emissions by approximately 20-25%, NOₓ by over 85%, and SOₓ emissions to almost zero6. In addition, LNG bunkering and propulsion technology is already widely available. More than 40% of new ships ordered globally are equipped with gas propulsion, in form of single- or dual-fuel. Market research7 indicates that the number of LNG-powered vessels operating in southern Baltic Sea region could increase up to eightfold by 2030. This means that Polish ports will have to handle a growing number of bunkering operations in the coming years, both for their own vessels and for international ships. In this context, LNG represents a reasonable step towards low-emission shipping that is already available today, before zero-emission fuel technologies such as green ammonia, methanol or hydrogen are fully developed.

Current solutions are not enough

LNG bunkering solutions currently in use in Poland are mainly truck-to-ship and small-scale deliveries. Truck-to-ship bunkering ensures delivery in theory, but it has significant limitations, resulting, among other things, from the capacity of road tankers (approx. 18 t/40 m³ of LNG). This solution therefore means slower ship handling, logistical constraints, higher unit costs, and less flexibility when accepting large vessels requiring ship-to-ship bunkering.

With growing demand, strict emissions regulations and the need for competitive bunkering services, it is necessary to equip the market with a dedicated LNG bunkering vessel that provides ship-to-ship delivery, thereby ensuring greater throughput, flexibility and logistical independence.

It is worth mentioning here that the future Polish BV could also be used for bioLNG export, by collecting locally produced biomethane from installations and mobile liquefaction units, stored in certified cryogenic tank and delivered to Polish ports (e.g. the port in Elbląg) by rail or low-emission road transport. Thanks to its strong agricultural sector, Poland has a great potential for bioLNG feedstocks. Although at the end of 2023 there were only a few hundred agricultural biogas plants, the technical potential is estimated at thousands of installations, which provides a solid source of raw material for bioLNG production on a large scale8.

Unit features for the Polish market

When analyzing the design parameters of upcoming LNG bunkering vessel, factors such as the anticipated demand for bunkering, the frequency of operations, port logistics, the size of target vessels and competitiveness aspects should be taken into account. Compared to major European hubs with access to LNG supplies (e.g. port of Rotterdam, port of Antwerp in the ARA region, or Trelleborg within the Baltic Sea) where bunkering vessels secure capacities of several thousand m³, Polish market is still in the development phase and doesn’t immediately require such a large vessel. A smaller BV would allow the launch of the project, lower entry costs and better adaptation to current demand. Assuming that the number of bunkering operations will increase during the year, a vessel with a capacity of 2000-5000 m³ can be considered reasonable in regional conditions, ensuring flexibility and frequency of service, but without an excessive margin of unused capacity. Such unit will be able to call at ports multiple times and handle several operations per week, delivering fuel within a few hours without causing delays for ships. Over time, as demand increases, a second unit or an increase in the capacity of the existing one may be considered.

Benefits and the impact on the Polish market

Having your own LNG bunkering unit in Polish ports offers a number of benefits. The key profit is that it increases the attractiveness of ports to shipowners with LNG or dual-fuel vessels and reduces logistical dependence on foreign bunkering operators. Shipowners calling at Polish ports will have an easy access to LNG bunkering, which may be a factor while choosing a particular port, increasing also the transit through the Baltic and North Sea regions. Polish multi-energy companies may also supplement their own product portfolios with LNG from the terminal in Świnoujście or the future FSRU in Gdańsk, which is currently under construction.

It is also important to comply with emission regulations in shipping and to strive to achieve decarbonization goals together with the entire maritime sector. It is worth noting that the implementation of Polish bunkering vessel project would also contribute to the development of local value chain. The design, construction, maintenance and ships’ operations will stimulate the development of shipyards, engineering companies and technology suppliers from Poland.

Polish design office ready to act

Polish maritime industry is prepared to implement an LNG BV project that meets both current and future needs of the domestic market. Our office has a significant experience in LNG vessel design and the conversion of older ships for the use as FSRUs (Floating Storage Regasification Units). We already have ready-to-implement concepts of bunkering vessels in our portfolio, that meet the regulatory and operational requirements of ports in Poland.

Based on available data, our own experience and analyses, we propose to offer LNG in two options – for short-range maritime transport such as ferries, ro-pax ships and feeders, and for deep-sea transport in the context of container ships and ocean tankers.

For short-range shipping and ferry vessels with typical LNG tank capacity in the Baltic Sea region ranged from 240 m³ (e.g. PolSca) to 500 m³ (e.g. TT-Line ferry), a 2000 m³ bunkering unit appears to be the optimal solution. Our SE-615 LNG Bunkering Vessel concept, with the length of 86 meters and a design draft of 3,8 m, is a ready-to-use proposal for this market segment. The design is adaptable for future expansion or, alternatively, for the use of other than LNG tanks, dedicated to future zero-emission fuels.

SE-615 LNG Bunkering Vessel for short-range shipping in the Baltic Sea

On the other hand, considering the needs of long-range shipping and bunkering of large vessels in Gdańsk, Gdynia and, in the future, Świnoujście, we developed SE-618 Shallow Draught LNG BV/Feeder concept – a vessel with the capacity of 5000 m³, 19,6 m wide and 4,0 m deep, designed to operate in waters with limited depth, with the ability to pass through the Vistula Spit and the shipping channel to Elbląg, which is currently being deepened and may in the future become a hub for Polish bioLNG export.

SE-618 Shallow Draught LNG BV/Feeder for long-range shipping in the Baltic Sea

Both projects show that Polish engineering is up to date with market needs and fully ready to design a ship and provide domestic ports with their own independent LNG bunkering fleet, designed in Poland and built in Polish shipyards, supporting the development of local content within offshore and sustainable shipping.

The construction of Polish LNG bunkering vessel is not only a needed investment, but also a strategic opportunity for Polish maritime sector and shipbuilding industry. European and Polish markets show a clear upward trend for LNG bunkering as a transitional fuel in shipping, as confirmed by numerous data and reports. Poland already has the appropriate entry infrastructure – developed LNG terminal in Świnoujście, floating FSRU terminal planned for 2028, small-scale LNG and truck-to-ship bunkering in ports. The implementation of a 2000-5000 m³ capacity unit will be adequate for the Polish market and will provide significant logistical, operational and competitive benefits. Furthermore, with the appropriate liquefaction infrastructure, certification and seasonal availability planning, Polish BV could also become a supplier of bioLNG for Baltic shipping, as well as a short-term exporter of this fuel, taking advantage of the position of our country as an agricultural producer.

Polish companies are ready to take on such a project – both in terms of ship design, construction and equipment. Polish shipbuilding industry and engineering resources possess necessary expertise and knowledge. It is worth to bet on local content, strengthening domestic supply chain, creating workplaces, developing local know-how and increasing national strategic independence. In addition, involving local entities can accelerate project implementation, reduce operating and logistics costs and facilitate cooperation with ports and institutions in Poland. Polish bunkering vessel project is a key element in building the competitiveness of our ports, supporting energy transition in shipping and strengthening Poland’s position as an active player in alternative fuels bunkering operations.